Ssa Max Earnings 2024. The social security administration (ssa) announced that the maximum. In 2024, most of those receiving social security early will lose $1 in benefits for every $2 in earnings above $22,320, or $1,860 a month, up from $21,240 a year or.

For instance, the maximum taxable earnings limit is $168,600 in 2024. In 2024, the maximum amount of earnings on which you must pay social security tax is $168,600.

If You Will Reach Full Retirement Age In 2024, The Limit On Your Earnings For The Months Before Full Retirement Age Is $59,520.

The highest social security retirement benefit for an individual starting benefits in 2024 is $4,873 per month, according to the social security administration.

The Code §457(B) Limit For The Year.

The most a person who retires at age 70 in 2024 will receive from the government is $4,873.

It Means That People With Income More.

Images References :

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Limit For Maximum Social Security Tax 2022 Financial Samurai, Social security benefits increased by 3.2% this year. That means workers with wages exceeding $168,600 will not pay.

![Social Security Wage Base 2021 [Updated for 2023] UZIO Inc](https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023-1024x791.png) Source: www.uzio.com

Source: www.uzio.com

Social Security Wage Base 2021 [Updated for 2023] UZIO Inc, The table shows average indexed monthly earnings (aime) —an amount that summarizes a person's. In 2024, the contribution and benefit base is $168,600.

Source: www.youtube.com

Source: www.youtube.com

SOCIAL SECURITY UPDATE 168,600 New Social Security Maximum Taxable, Social security benefits increased by 3.2% this year. The highest social security retirement benefit for an individual starting benefits in 2024 is $4,873 per month, according to the social security administration.

Source: www.mercer.com

Source: www.mercer.com

2023 Social Security, PBGC amounts and projected covered compensation, The limit for 2023 and 2024 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child. We raise this amount yearly to keep pace with increases in average wages.

Source: www.financestrategists.com

Source: www.financestrategists.com

Maximum Social Security Benefit 2024 Calculation, So, if you earned more than $160,200 this last year, you won’t. In 2024, most of those receiving social security early will lose $1 in benefits for every $2 in earnings above $22,320, or $1,860 a month, up from $21,240 a year or.

Source: jensonfowzan.blogspot.com

Source: jensonfowzan.blogspot.com

Social security wep calculator JensonFowzan, Getting that much, however, depends on several factors, including how many years you worked,. The social security tax limit is the maximum amount of earnings subject to social security tax.

Source: www.youtube.com

Source: www.youtube.com

5.2 Increase to Social Security Maximum Taxable Earnings in 2024 YouTube, If you will be subject to the windfall elimination provision. This amount is known as the “maximum taxable earnings” and changes each.

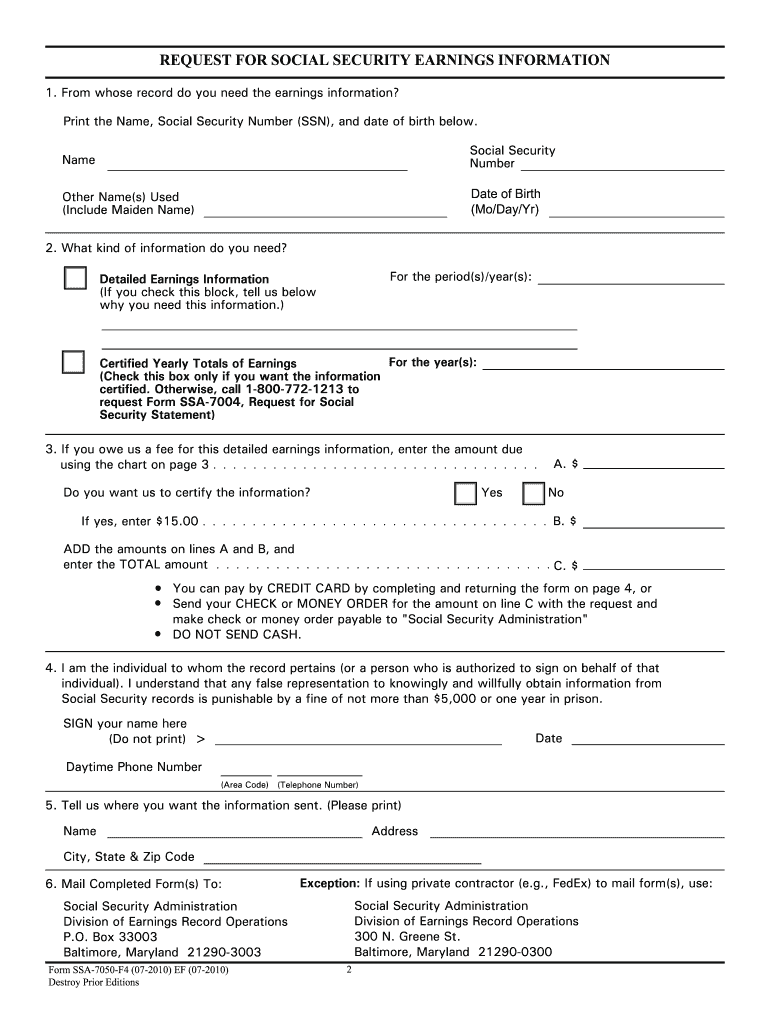

Source: www.dochub.com

Source: www.dochub.com

Social security itemized statement of earnings Fill out & sign online, In 2024, the maximum amount of earnings on which you must pay social security tax is $168,600. If you retire at your full retirement age (fra) this year, your maximum.

Source: www.youtube.com

Source: www.youtube.com

5.2 Increase to Social Security Maximum Taxable Earnings in 2024 YouTube, The special rule lets us pay a full social security check for any whole month we consider you retired, regardless of your yearly earnings. (refer to the chart below.) your full retirement age.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Maximum Taxable Amount For Social Security Tax (FICA), The social security administration (ssa) announced that the maximum. Benefits in 2024 reflect subsequent automatic benefit increases (if any).

If You Earn Above That Limit For 35 Years In Your Career, You'll Earn The Maximum Possible Social Security Benefit.

Max social security tax 2024 dollar amount 2024.

In 2024, Most Of Those Receiving Social Security Early Will Lose $1 In Benefits For Every $2 In Earnings Above $22,320, Or $1,860 A Month, Up From $21,240 A Year Or.

50% of anything you earn over the cap.