Texas Unemployment Taxable Wage Base 2024. 2024 tax calculator for texas. We’ve compiled a comprehensive list of 2024 suta wage bases for each state, making it easier for you to stay compliant and manage your payroll taxes effectively.

For three decades, texas has held its taxable wage base for ui at $9,000 — meaning, $9,000 is the maximum amount of earnings on which a texas employer pays ui tax for. State unemployment tax assessment (suta) is based on a percentage of the taxable wages an employer pays.

To Access The Chart From The.

We’ve compiled a comprehensive list of 2024 suta wage bases for each state, making it easier for you to stay compliant and manage your payroll taxes effectively.

An Updated Chart Of State Taxable Wage Bases For 2021 To 2024 (As Of February 7, 2024) May Be Downloaded From The Payroll.org Website.

Some states apply various formulas to determine the taxable wage base, others use a percentage of the state’s average annual wage, and many simply follow the futa wage.

Texas Unemployment Taxable Wage Base 2024 Images References :

Source: alisonqfrancoise.pages.dev

Source: alisonqfrancoise.pages.dev

Texas Suta Wage Base 2024 Fifi Orella, Here’s how an employer in texas would calculate suta: An updated chart of state taxable wage bases for 2021 to 2024 (as of february 7, 2024) may be downloaded from the payrollorg website.

Source: amaletawbobbye.pages.dev

Source: amaletawbobbye.pages.dev

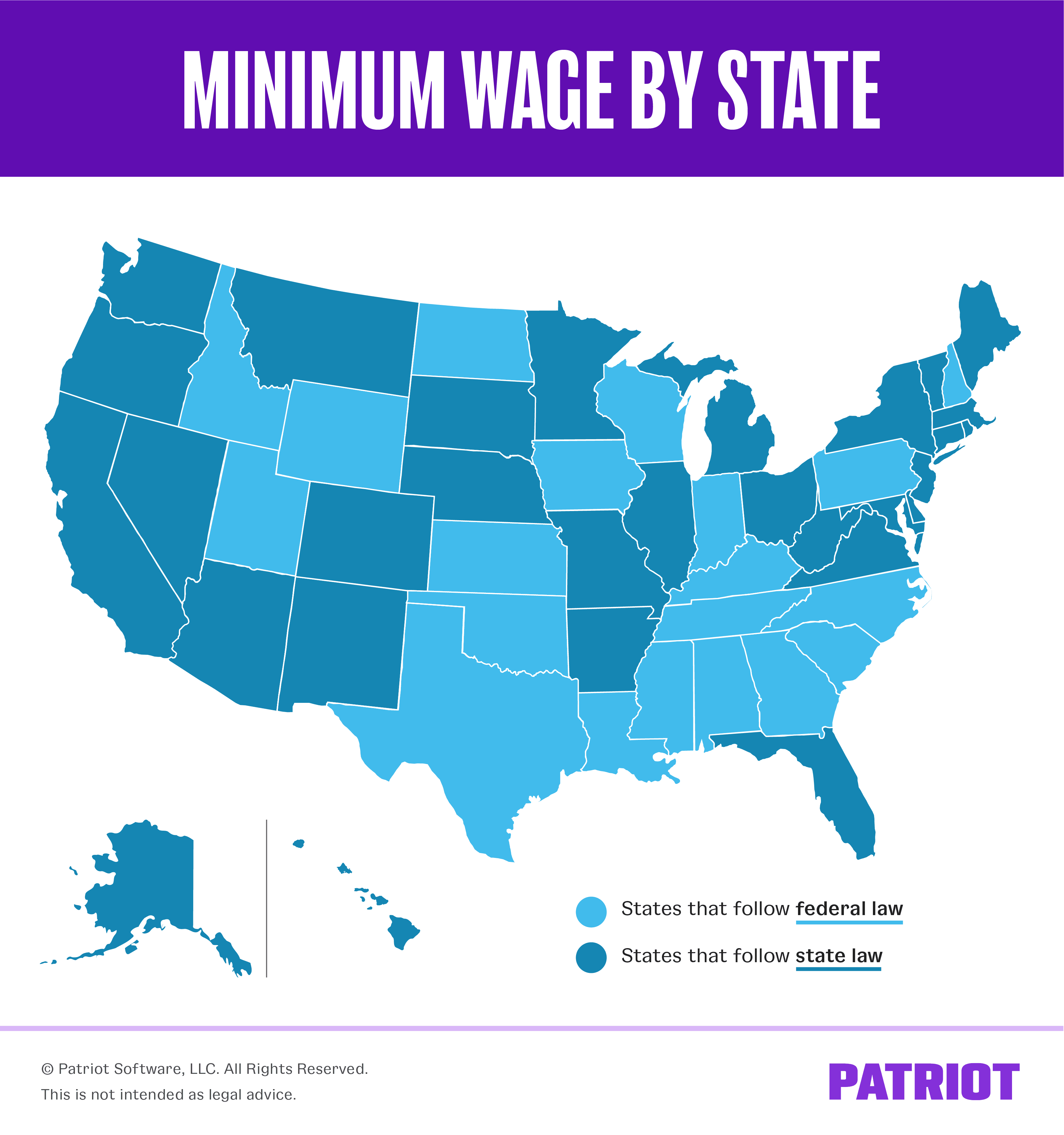

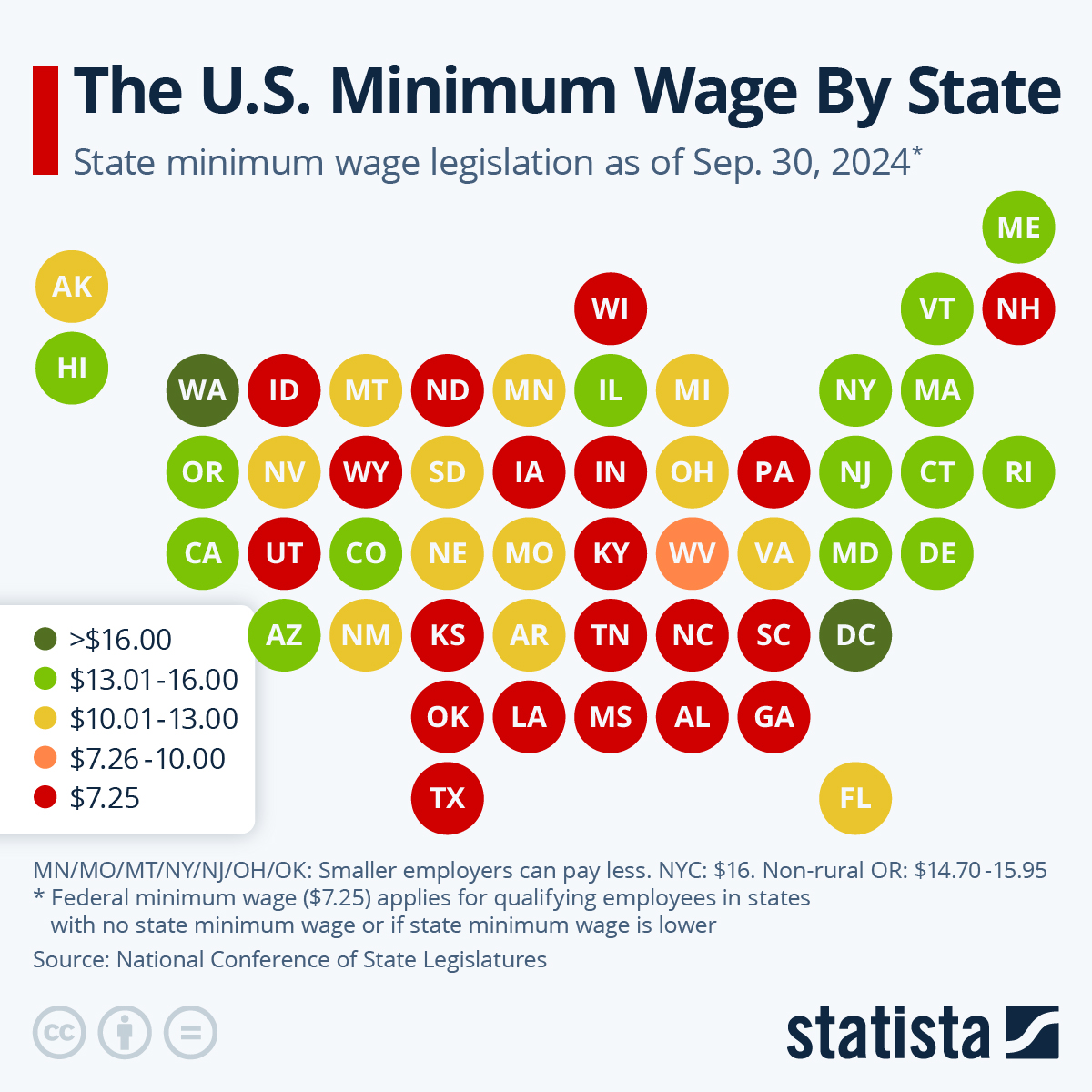

Minimum Wage In Texas 2024 Per Hour Calculator Celine Lavinie, The wage base means you only contribute. 2024 tax calculator for texas.

Source: clarieqmirabel.pages.dev

Source: clarieqmirabel.pages.dev

Employer Federal Unemployment Tax Rate 2024 Jilly Lurlene, Texas unemployment tax rate 2024. Penalties and interest are assessed on late reports and tax payments.

Source: myrtiawede.pages.dev

Source: myrtiawede.pages.dev

2024 State Unemployment Tax Rates Libby Othilia, Some states apply various formulas to determine the taxable. The 2022 sui taxable wage base was $17,000, then $20,400 in 2023, $23,800 in 2024, and $27,200 in 2025.

Source: example-of-twc-work-search-log.pdffiller.com

Source: example-of-twc-work-search-log.pdffiller.com

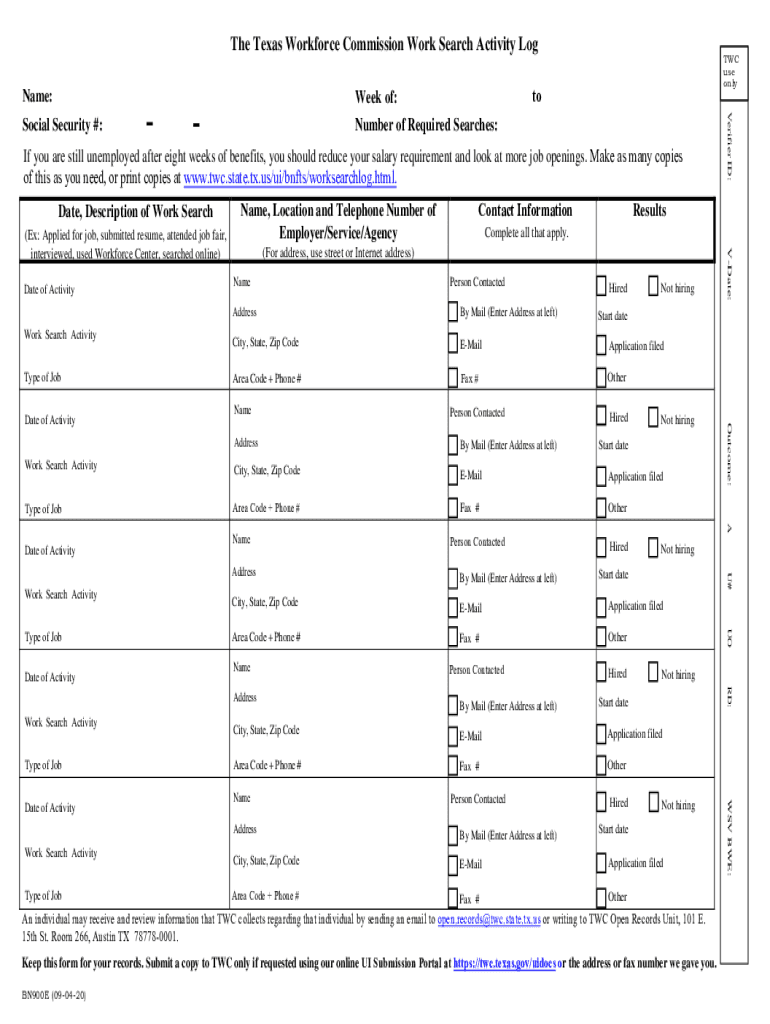

20202024 Form TX TWC BN900E Fill Online, Printable, Fillable, Blank, The 2024 tax rates and thresholds for both the texas state tax tables and federal tax tables are comprehensively integrated into the texas tax. Texas unemployment tax rate 2024.

Source: allyqroxane.pages.dev

Source: allyqroxane.pages.dev

Unemployment Payment Schedule 2024 Mady Sophey, To access the chart from the. The wage base means you only contribute.

Source: quickbooks.intuit.com

Source: quickbooks.intuit.com

TX Unemployment Insurance Tax, Pursuant to hb 6633 passed in 2021, the. An updated chart of state taxable wage bases for 2021 to 2024 (as of february 7, 2024) may be downloaded from the payroll.org website.

Source: www.epi.org

Source: www.epi.org

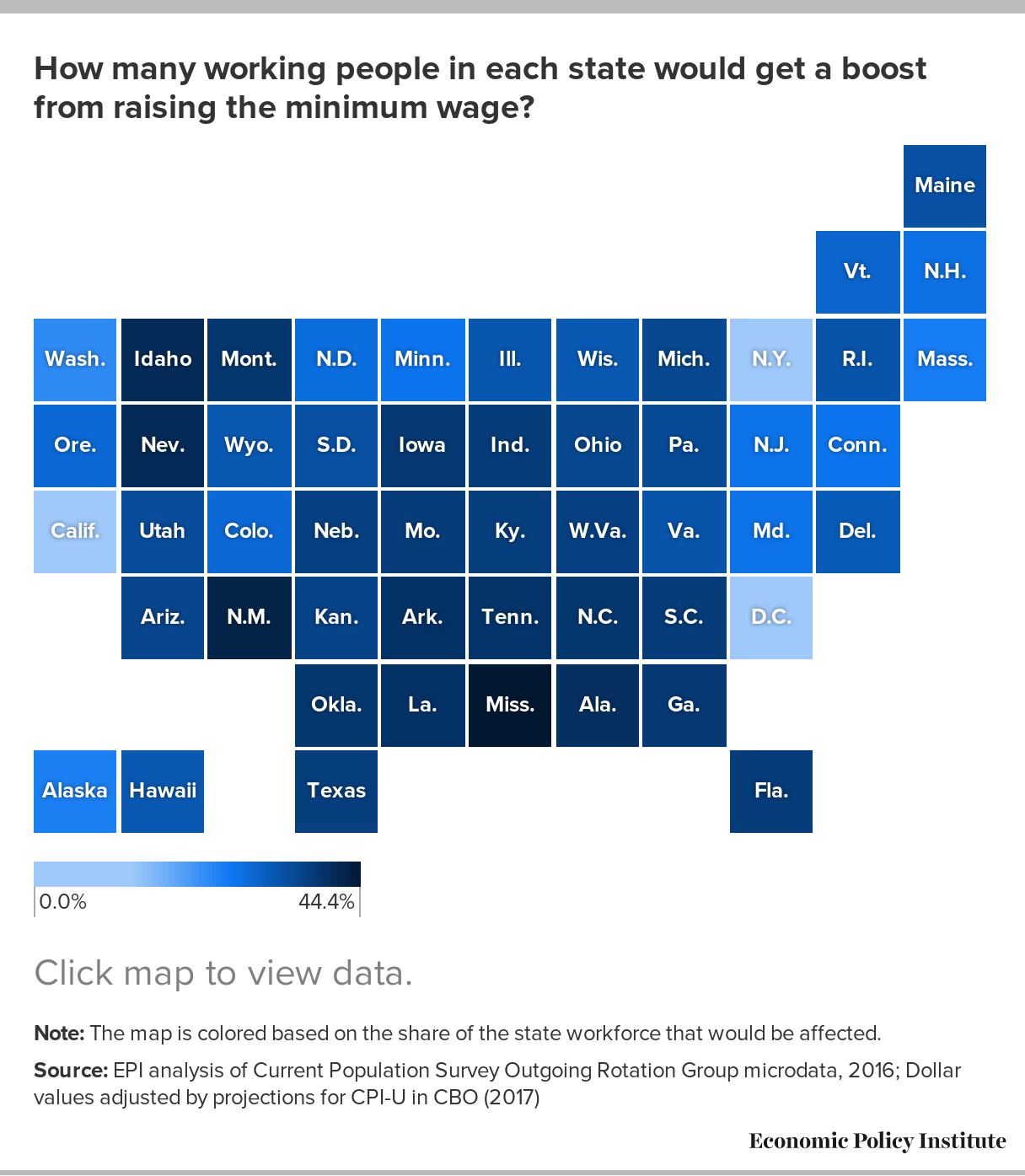

Raising the minimum wage to 15 by 2024 would lift wages for 41 million, Every state has a different annual sui tax rate, a different tax rate range, and a different wage base for unemployment tax. Here’s how an employer in texas would calculate suta:

Source: jankaqvictoria.pages.dev

Source: jankaqvictoria.pages.dev

State Unemployment Tax Rates 2024 Rory Marlee, An updated chart of state taxable wage bases for 2021 to 2024 (as of february 7, 2024) may be downloaded from the payroll.org website. For three decades, texas has held its taxable wage base for ui at $9,000 — meaning, $9,000 is the maximum amount of earnings on which a texas employer pays ui tax for.

/https://static.texastribune.org/media/images/TWFC_Unemployment.jpg) Source: www.texastribune.org

Source: www.texastribune.org

On the Records Shifting Unemployment Rates in Texas The Texas Tribune, Wage base and tax rates. Pursuant to hb 6633 passed in 2021, the.

An Updated Chart Of State Taxable Wage Bases For 2021 To 2024 (As Of February 7, 2024) May Be Downloaded From The Payrollorg Website.

Following is the final list of the 2024 sui taxable wage bases as of january 16, 2024 (as compared to 2023) and employee sui withholding rates, if applicable.

Some States Apply Various Formulas To Determine The Taxable.

That amount is known as the taxable wage base or taxable.